geothermal tax credit iowa

Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return. This rule making implements the Iowa geothermal heat pump income tax credit enacted in 2019 Iowa Acts House File 779 for geothermal heat pumps installed on residential property in Iowa on or after January 1 2019.

Geothermal North Central Iowa Service

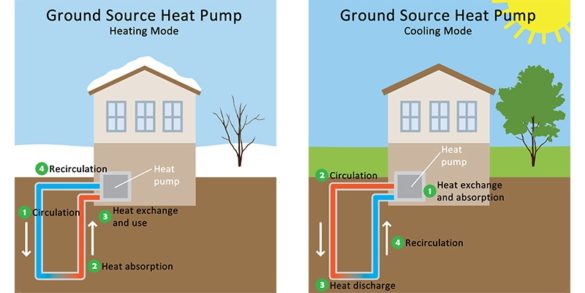

The tax credit equals 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool the dwelling.

. Its a dollar-for-dollar reduction on the income tax you owe. The federal credit is set to expire December 31 2016. Effectively a 52 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 26 for tax years 2020 through 2022.

The Credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019. Electrical upgrades may also be eligible. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit.

1 2019 and is available for Iowa homeowners on Iowa residential properties. Effective for installations between January 1 2012 and December 31 2016 and for installations after January 1 2019 a Geothermal Heat Pump Tax Credit is available for individual income taxpayers equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps provided in section 25Da5 of the Internal Revenue Code for. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs.

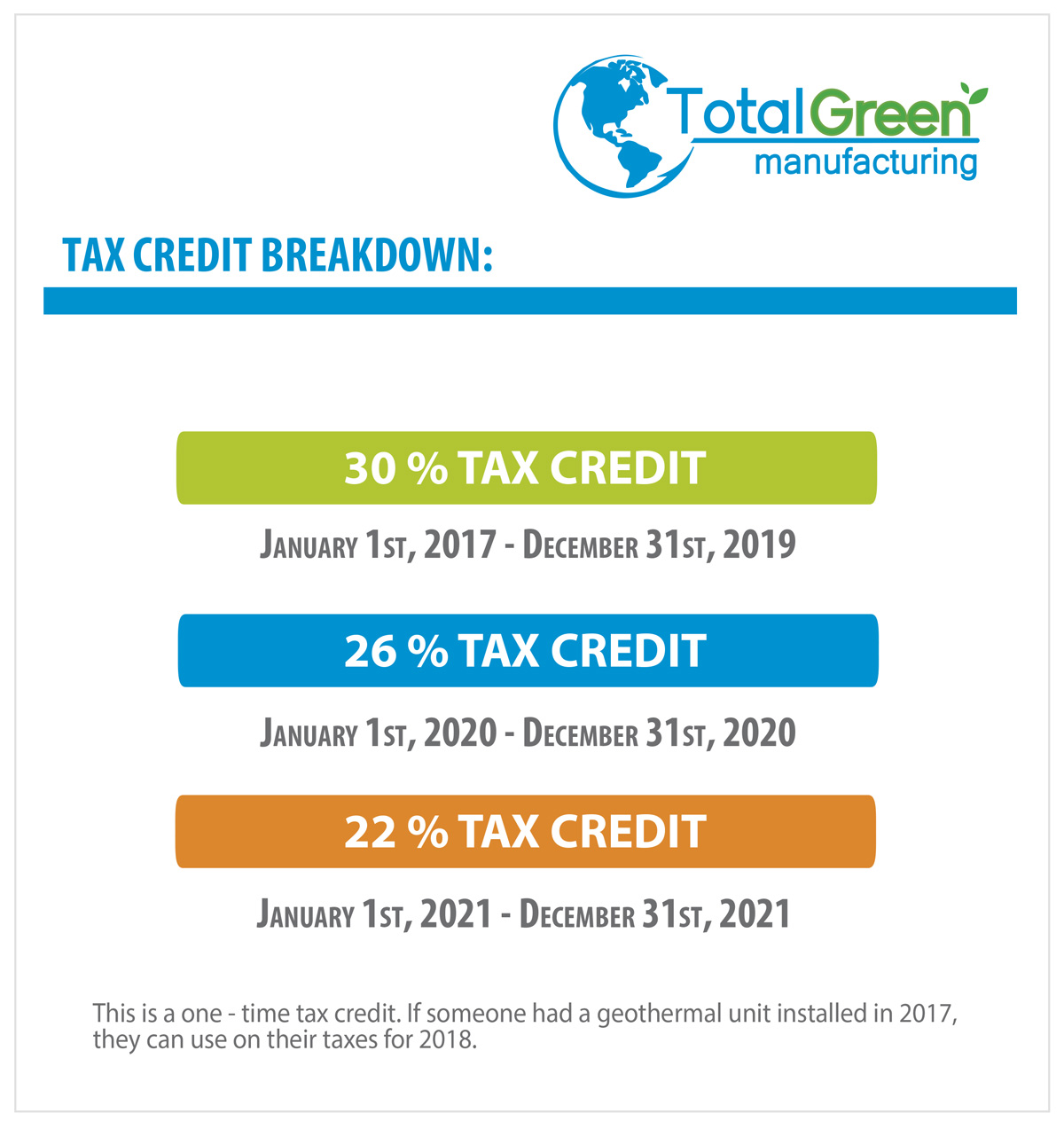

Lets break down what that means. The federal credit was later reinstated and the Geothermal Heat Pump Tax Credit was available to Iowa taxpayers again beginning with tax year 2019. Bryan DeJong of Baxter Oil Company Baxter IA and Justin Larsen of Camblin Mechanical Inc Atlantic IAQuick FactsFederal Tax Credit.

Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. The Geothermal Tax Credit was repealed in 2018 SF 2417. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what you owe.

Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return. The Geothermal Tax Credit is classified as a non-refundable personal tax credit. The Geothermal Tax Credit covers expenses including labor onsite preparation assembly equipment and piping or wiring to connect a system to the home.

The State credit equals 200 of the federal Residential Energy Efficient Property Credit. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022. When multiple housing cooperatives or horizontal property regimes incur expenses that qualify for the tax credit taxpayers owning and living in the units are treated as having made their proportionate share of any qualified geothermal property expenditures made by the cooperative or regime.

GEOTHERMAL IOWA STATE TAX CREDIT. The credit will be available to consumers on a first-come first-served basis with a cap on total funds available of 1million annually. There will be a wait list if the funds are depleted for the year.

The tax credit equaled 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs. Most local utilities offer a handsome incentive for geothermal installationHow it.

The credit is available for units installed on or after Jan. The Credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019. The Geothermal Tax Credit did not require a federal credit and therefore was available during years when there was no federal geothermal credit.

Iowa had a short term program for geothermal and the funding was depleted in short orderOther Local Incentives. The Geothermal Heat Pump Tax Credit is available for qualified installations on residential property located in Iowa. In order to qualify for the Federal Tax Credit you must have some level of.

For geothermal heat pump units installed on or after January 1 2019. The credit is available for units installed on or after Jan. This new income tax credit replaces previous geothermal-related income tax credits that were repealed by the Iowa legislature effective in 2019.

The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022. Applicants on a waitlist will be first in line for the next year. The equipment must meet the federal energy star.

Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax liability equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps in residential property located in Iowa. Add-on components like ductwork or. The Iowa Geothermal Tax Credit is.

Eligible for a new Iowa Geothermal Tax Credit in 2018. 2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers residence or as a thermal energy sink to cool the residence. 1 2019 and is available for Iowa homeowners on Iowa residential properties.

Available to the residentowner of an Iowa residence who installs geothermal at that residence.

User Financial Incentives Green Up West Union

Federal Tax Credit Only For A Limited Time Waterfurnace

Geothermal Heating And Cooling Sioux City Iowa Excel Comfort Inc

Geothermal Systems Geothermal Heating Oelwein Ia

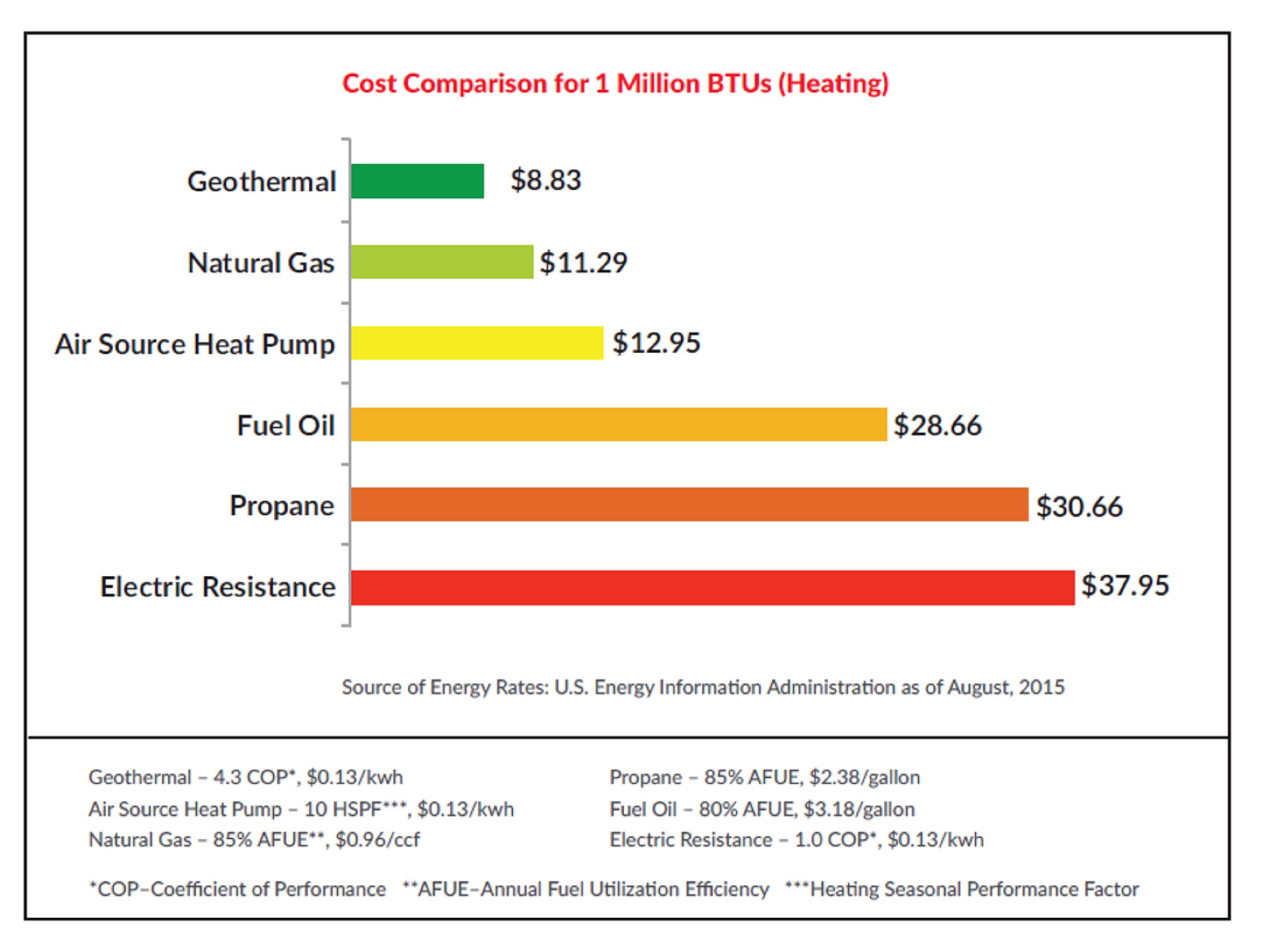

Savings From Buying Geothermal

2022 Iowa Legislative Session Week 7 Summary

Contact Us Northeast Iowa Mechanical

Geothermal North Central Iowa Service

Federal Geothermal Tax Credits Are Back

User Financial Incentives Green Up West Union

City Wide Heating And Cooling Furnace And Air Conditioning Experts

Geothermal Heat Pumps Western Iowa Power Cooperative

Federal Geothermal Tax Credits Are Back

Federal Tax Credit Only For A Limited Time Waterfurnace

Geothermal North Central Iowa Service

Savings Calculator How Much Waterless Dx Geothermal Can Save You